Hello,

Gerald,Swamiji and Group

I recommend to follow these steps:

1) Rough estimation, watch these digits:

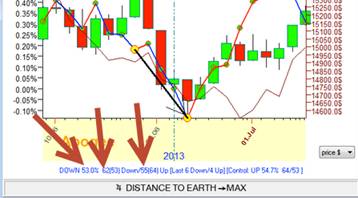

Ok, it shows Down 64 downs versus 55 ups

2) Control group: why it goes down? It goes down because this astro phenomena or

because price goes down for some other reason i.e. down trend?

Watch these digits:

I will show you example: I've downloaded SP500 since end of 2011. Stock market

is in up trend mode since that moment. Now we will calculate the Moon

effect, i.e. New Moon,Full Moon, Moon square Sun. Here are efficiency tests for

these phenomena:

You see, all models show UP. But look at this: Control groups show the same -

Up. When real up/down values close to Control group values it means that the

analyzed event is not important. The difference between real up/down and

control group should be big enough otherwise these results should be classified

as ARTIFACT (price goes up not because aspect but because uptrend).

To evaluate this difference we have to apply chi square significance

criteria: http://www.timingsolution.com/TS/Study/Stat/index.htm

3) There is a big problem with all financial data: we should be always

ready that stock market will change his Game rules. So I recommend always to

check how the analyzed phenomena works based on recent price history, let's say

10-20 latest cases. I mean this parameter:

Use last %X trades as confirmation criteria, just to be sure that the analyzed

phenomena is still working and stock market has not changed his rules. You can

ignore the big % based on last %X trades.

Best regards.

Sergey.