The update for Terra is available. This is what I did between visits, shopping,

gatherings ...

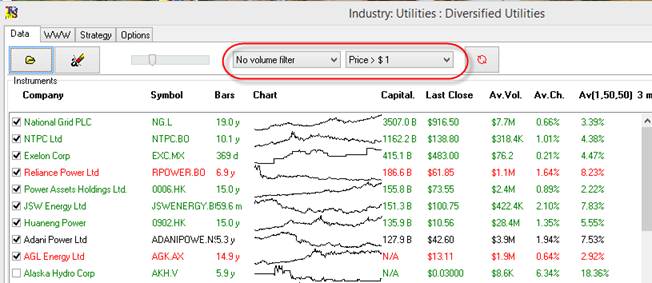

There are some changes in Market sectors module, it works significantly more

stable and faster now. I tried to find some balance between managing high value

stocks and penny stocks. I think that I have found a solution.

First of all, pay attention to filters there; they allow to pick up stocks

according to their averaged volume and last closing price:

Initially I used volume filter mostly, unchecking all stocks with average

volume less than 100K (in first version it was 500K).

Now I think that volume is not a big player here. It is more important to see

the stock chart itself within a significant period of time (it is displayed in

a new version now). I mean, if it is flat, maybe it is better to not consider

that stock at all (when calculating the performance of the sector as a whole).

I am testing this idea now.

Next thing is:

The strategy calculation works now 10 times faster.

This is how this module can be used:

1) you need to pick up a stock for your next trade. Start with applying a

standard system (there are many of them, maybe a suggestion of your broker).

2) Then download your stock chart and check its Annual cycle; compare it to the

stock chart (I recommend to do that using Natural Cycles module and moving LBC

across the chart - just to see that the stock really follows the forecast

provided by its Annual cycle).

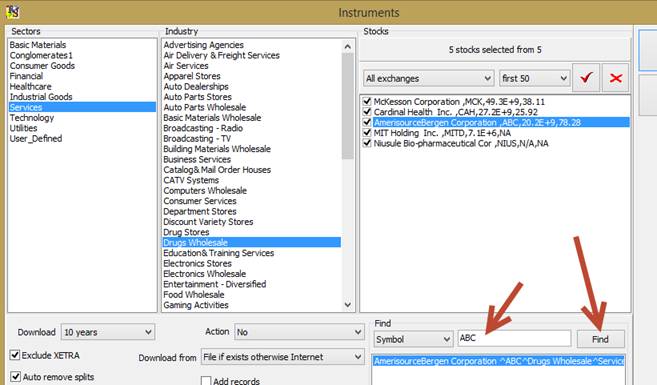

3) Then check the industry of that stock. You can do that in two different

ways: a) type the stock symbol here:

The program will find the industry that stock belongs to. We have now the

listings for about 23K stocks.

b) Just learn the stock profile, define yourselves what industry it belongs to

and then find the industry in this list:

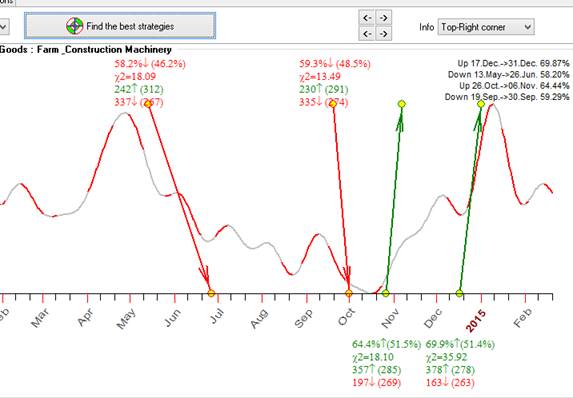

4) Then calculate the Annual cycle for the industry. See the dates when it goes

up or down. It could be hints for your choice of your next stock to trade:

Best regards.

Sergey.